Reasons Which Affects Oil Prices

Susan Kelly

Oct 20, 2023

The effect of affecting the price of oil. Since of this, the price of oil fluctuates daily because it depends on the previous day's trading activity. Traders choose their bids based on their opinions of the supply and demand in the market. Other organizations, can influence trade or modify the volume of oil produced and stored, which may affect the traders' judgments on their bids. It is general knowledge that the oil market is the most unpredictable of all commodity markets. Suppose you are thinking of trading in oil or oil derivatives. In that case, it is beneficial to understand the elements that determine the price of oil and how traders, governments, and consumers all impact it.

Traders Are Major Oil Price Influencers

The execution of oil futures contracts takes place on the trading floor of a commodity exchange. This is an exchange where only commodities are exchanged. Two of the most well-known commodities exchanges in the world are the Chicago Mercantile Exchange and the New York Mercantile Exchange. Contracts for oil futures are agreements to purchase or sell oil at a specified future date at a price agreed upon by both parties. Oil derivatives are financial instruments traded on exchanges and depend on oil's underlying price. Hedgers are individuals who represent businesses that either produce or consume oil.

Three Factors Traders Use to Determine Oil Prices

When establishing the bids that impact oil prices, commodities dealers primarily consider the following three factors: The present supply, anticipated future supply, and anticipated demand are listed below.

Present Availability

The present supply of oil equals the entire production of all countries combined. Because it is responsible for producing over forty percent of the world's crude oil, the Organization of the Petroleum Exporting Countries (OPEC) significantly influences the prices at which oil is traded across the globe. Shale oil output in the United States increased from one million barrels per day (b/d) in January 2011 to over 4.8 million barrels per day (b/d) in December 2014. An oil glut was produced due to this rise in output, which implies a greater oil supply than the demand for it.

Future Supply

The availability of oil reserves is necessary for future supply. It considers all that is now accessible at refineries in the United States and in the Strategic Petroleum Reserves. According to the criteria outlined in the Energy Policy and Conservation Act of 1975, or if natural disasters reduce the flow of oil into the United States.

Demand

Investors pay attention to the global demand for oil, notably in China and the United States. The Energy Information Administration produces monthly estimates for the United States. Gasoline demand is highest during the summer driving season and at its lowest during winter.

Effect of Disasters on Oil Prices

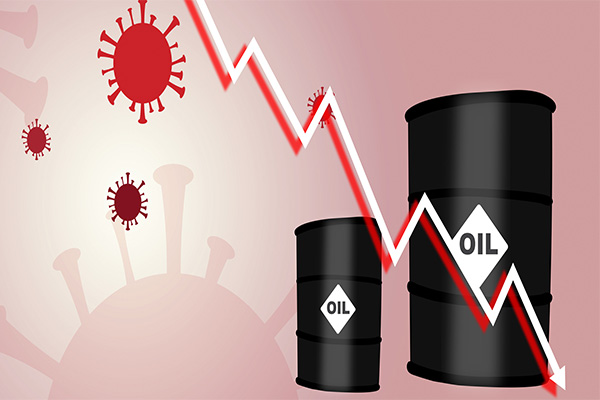

If they are severe enough, both natural catastrophes and those caused by humans may affect the price of oil. Pandemics and natural calamities have significantly impacted oil prices in recent times.

COVID-19 Pandemic

To combat the spread of the coronavirus pandemic, several countries started imposing travel restrictions and halting companies in January 2020. As a direct consequence, the oil demand started to decrease. Oil consumption fell by 5.6 million b/d compared to the same period in the previous year, coming in at a quarterly average of 94.4 million b/d in the first quarter of 2020.

Oil Spills

Surprisingly, oil spills do not increase the price of oil. Even though this had a catastrophic effect on the coastline of Alaska, neither the availability nor the price of oil was affected in any way.

How World Crises Impact Oil Prices

Oil prices skyrocket whenever there is either an actual crisis or widespread worry that there may be one in a country that produces oil. Traders are concerned that the crisis may reduce the amount of oil available, boosting both demand and prices.

Iran

This is precisely what took place in January of 2012 when inspectors discovered further evidence that Iran was getting closer to being able to produce nuclear weapons. The United States and the European Union implemented financial penalties, and Iran threatened to seal the Strait of Hormuz in retaliation (a major oil shipping lane).

Arab Spring

High oil prices are also caused by turmoil across the world. The instability in various countries, notably Egypt, Tunisia, and Libya, caused investors to become anxious in March of 2011. (called the "Arab Spring"). As a direct consequence, the price of oil climbed over $100 per barrel at the beginning of March and reached a high of almost $113 per barrel in late April. An oil glut was produced due to this rise in output, which implies a greater oil supply than the demand for it.