Buy A Second House, Rent The First In 5 Stages

Susan Kelly

Feb 03, 2024

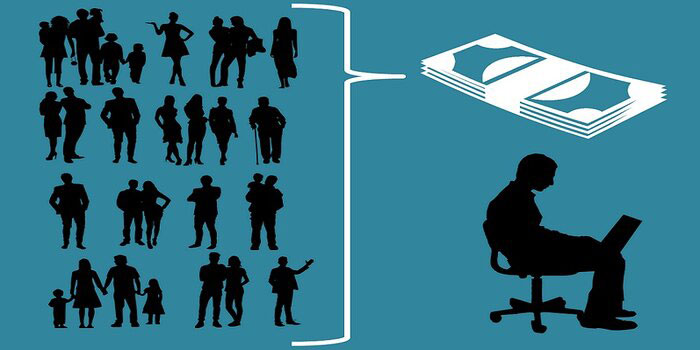

Not long ago, the typical homeowner would sell their current residence before purchasing a new one. Only the top 1% of the population with relevant connections could afford to own rental properties. These days, more and more people are buying a second home to use as a rental property to supplement their income and increase their wealth over the long term. There are several pros to renting a first home, but there are also some cons to consider.

The Advantages of Renting Out Your Residence

It could appear the easiest option to sell your present house and get a new one. However, there are advantages to renting out the first house and utilizing the money to purchase a second one.

Rental Income

The mortgage, property taxes and insurance, HOA fees, and maintenance are all paid for using the rent received from tenants each month. A positive cash flow means the landlord has money left over after each accounting period.

Tax Benefits

U.S. tax policies favor those who invest in real estate. Landlords may be allowed to deduct expenditures such as travel to and from rental properties, continuing education, and home office use from their rental revenue in addition to the usual operational expenses.

Create A Fortune

"Real estate investing, even on a very modest scale, is a tried and tested technique of creating an individual's cash flow and wealth," stated Robert Kiyosaki, best-selling author of Rich Dad Poor Dad. For some people, the first step toward financial independence is keeping their current house and renting out the extra space.

5 Steps To Buy A Second Property And Rent First

It's important to weigh the pros and cons of having two houses, as there are several advantages to renting out the first one. If you want to buy a second house and lease out your first, these are the five fundamental actions you need to take.

Take Stock of Your Financial Status.

Having two mortgages to pay might strain your budget if you own two properties. Some financial experts advise waiting to buy a second property until after debts with high-interest rates have been paid off, a workable budget has been established, and an emergency fund has been established. The expenditures associated with renting out the first house might be better understood by consulting a financial planner or a property manager.

Get Another Down Payment

The down payment required to purchase a second property may be a little challenge to overcome. Equity in a first residence can be used as collateral for a loan to pay for the purchase of a secondary residence in the form of a home equity loan or home equity line of credit (HELOC).

You can also get a loan from family or friends, take money out of your retirement savings, or perform a cash-out refinance to generate a down payment.

Ensure The First House Will Be A Viable Rental Property

Although rental properties are in high demand in many areas, not all properties are created equal in terms of revenue. Roofstock's handy Excel template makes examining a property's potential return on investment simple.

It may be used to estimate a property's future profit. Key return on investment (ROI) measures such as cash flow, cash-on-cash return, net operating income, and cap rate may be easily estimated after entering basic data.

Manage The Rental Property

Being a landlord and maintaining a rental property on your own usually involves doing things like:

- Learning about federal fair housing regulations and local landlord-tenant statutes

- Making a house more rentable by sprucing it up to appeal to potential occupants

- Advertising the property, conducting tenant screenings, and drafting a lease

- Maintenance and repairs, on-time bill payments, and property inspections are just some of the responsibilities of a property manager.

- Evicting a tenant for nonpayment of rent or giving them the required notice before raising their rate.

5. Establish An Efficient Accounting Procedure

A surprising quantity of documentation is required when renting out even a single property. Things like leases, receipts for rent and maintenance payments, and correspondence between the landlord and renter should be filed away in a safe place.

Stessa's free financial software for rental properties streamlines revenue and spending monitoring, increasing the likelihood of turning a profit and qualifying for every possible tax break available to real estate investors.

Concluding Ideas

Not everyone should sell their primary residence and buy a rental, but with the rising demand for rental property, it's an alternative worth exploring. You should weigh the benefits and drawbacks, evaluate your current financial standing, and do the math to determine the possible return on investment before transforming your primary residence into a rental property.