Do You Know: What Is Form 1099-A?

Triston Martin

Jan 05, 2024

Introduction

Form 1099-A, Acquisition or Abandonment of Secured Property, must be filled out to report the foreclosure process. This form may be issued to you if your mortgage lender has cancelled all or part of your mortgage due to foreclosure or a short sale. This paperwork could also be sent to you if your mortgage lender completed a short sale on your property. The mortgage companies who issued loans on the foreclosed property will send you a separate Form 1099-A. Debt cancellation is income and necessitates filing Form 1099-A with the Internal Revenue Service. The fact that you were able to get a mortgage loan in the first place and then stop making payments on it indicates that you have a regular source of income. Depending on the particulars of your position, this income might or might not be taxable.

Definition and Examples of Form 1099-A

Form 1099-A details the "Acquisition or Abandonment of Secured Property" during the tax year. If your house goes through foreclosure, your mortgage lender will likely hand it over to you so you can stay in it while you file your taxes. The IRS treats a foreclosure similarly to a sale of a property. In this scenario, there is no "selling price," at least not in the conventional sense where one might walk away from a typical sale with cold hard cash. It would help if you still determined whether or not you have a capital gain or loss.

Debt cancellations may be reported as income, but this is something to consider. For instance, if you borrowed $150,000 to put down on the house but then had some form of financial difficulty and could no longer afford the mortgage. Even if you are no longer obligated to make payments on a $125,000 loan that was outstanding when the lender foreclosed, the Internal Revenue Service considers this to be $125,000 in income for you. Form 1099- I will report this transaction to the IRS and send you a copy so you can include the relevant information in your tax return.

Who Uses Form 1099-A?

The lender must file IRS Form 1099-A and give the borrower a copy. Copies must be given to all borrowers if more than one person or entity is liable for repaying the loan. Each borrower must then take responsibility for recording this data and their share of the transaction on their tax returns.

What to Do if You Don't Receive Form 1099-A

If you have not received a Form 1099-A from your lender by January 31, following the year your house was repossessed, you should contact them immediately. The financial institution has until February 28 to provide you with a copy of the form, even though it must be submitted to the IRS considerably earlier. Alternatively, you can contact the lender directly to dispute the accuracy of the data they have on file for you. Any questions about the 1099-A should be directed to the designated contact at the institution listed on the form.

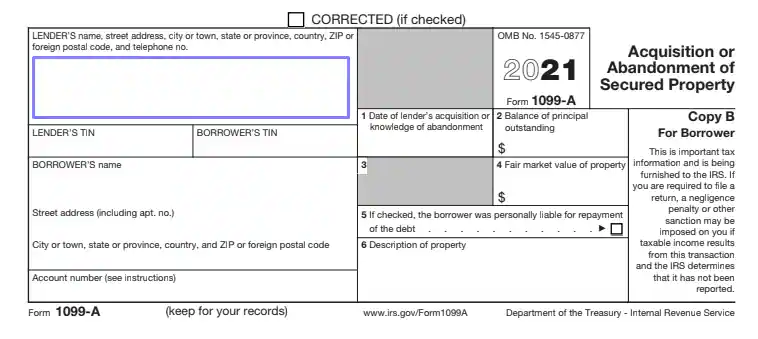

How to Read Form 1099-A

The date of sale and sales price of the repossessed property is included on the 1099-A and must be reported to the IRS as part of the foreclosure process. The foreclosure sale price can be set at either the outstanding loan debt or the home's fair market value as of the foreclosure sale date. Box 2 of the 1099-A details the remaining balance of the loan, while box 4 describes the property's fair market value. In Box 1, you'll see the foreclosure sale date, the date the property will be auctioned. Further, taxpayers need to know whether or not the loan in question was a recourse loan.

Box 5 of the 1099-A asks, "Check if the borrower was personally accountable for repayment of the debt." If the lender checked this box, then the loan was likely a recourse loan. On the reverse side of the form, you'll find this space. The selling price must be recorded on Schedule D of Form 1040, "Capital Gains and Losses," along with any relevant information. Depending on which is higher, this will be either box 2's amount or box 4's amount. If you need help deciding which box to check, it's best to go to a local tax professional. State financing regulations will dictate the correct box.

Conclusion

A copy of Form 1099-A would be mailed to you by your lender if you were required to surrender a home or other real estate property due to foreclosure. If more than one mortgage or loan is recorded against a piece of property, you may receive multiple 1099-A forms. Usually, you have until January 31 of each year to get them in the mail. As part of your tax filing, you'll need to include details about the foreclosure that were provided to you on Form 1099-A. Schedule D of Form 1040 is where you'll want to enter this data; it's where you'll report any capital gains or losses. Take the home's current fair market value and subtract the tax basis you have in the property, which is the purchase price minus any modifications. This will tell you whether or not you earned a profit.